"We have a culture that encourages innovation, empowered by an environment of trust and transparency."

WORK FOR US

We’re more than a staffing and transformation agency, we’re a movement that is creating impact, for our customers, our communities and our people.

SHAKING UP THE INDUSTRY

WORKING AT TRINNOVO GROUP

When you join Trinnovo Group, you join a B Corp accredited, award-winning consultancy, powered by our unique communities. We truly believe that great culture builds high performance, and our incredible career pathways and industry-leading commission structure help our people to build the lives they want in an environment they love.

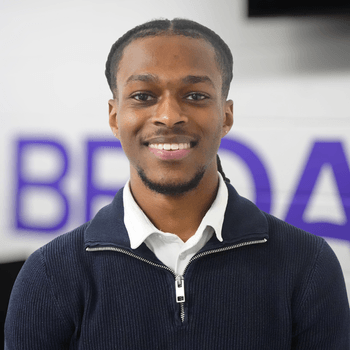

Ashley Lawrence

Group CEO & Founder

WE WANT PASSIONATE PEOPLE TO DRIVE THE GREATEST POSSIBLE IMPACT.

We are passionate about building a better workplace for everyone. We are a diversity-led recruitment consultancy, with three recruitment brands: Trust in SODA (Digital Tech), Broadgate (Business Protection), and DeepRec.ai (AI & Blockchain); and four community groups: Women in DevOps, Ex-Military Careers, Pride in Tech and Ethnicity Speaks. We also have Socials, with events, podcasts and blogs; Broadgate Social, DeepRec.ai Social and SODA Social.

We want everyone to be their authentic selves at work and we do this by creating an open, diversity-led, culture where inclusion and kindness is the norm not the exception, with everyone feeling safe and supported to be the very best version of themselves.

LIFE AT TRINNOVO GROUP

LIFE AT TRINNOVO GROUP

CAREER PATHWAYS

Clearly defined career pathways offer our people the chance to explore a wealth of new opportunities within the business. Transparency and accountability underscore every move we make, and the same goes for career progression. We invest in our people, and we give them the structure they need to progress to the next level.

LIVE JOBS

IMPACT STORIES

Within three months as an Associate, I made my first placement, exceeding my own expectations. I’m grateful for the Academy and the chance to develop professionally in such a dynamic environment.

WELL-BEING AND WORK-LIFE BALANCE

It’s important to us that everyone feels like they are heard and have a sense of belonging. We offer amazing perks which ensure our people are rewarded, have fun, and have a healthy work-life balance. Check out the perks and offerings available to our team.

CAREER MOBILITY STORIES

As a multinational organisation with offices in London, Zug, Boston, and Dublin, we’re well-equipped to support career mobility. Our people come from all over the world, representing the diversity of thought and experience needed to inspire innovation.

OUR INTERNAL DIVERSITY NETWORKS

Our diversity network was established to cultivate inclusivity and make a measurable, positive impact through the work we do. Employee-led and purpose-driven, our internal engagement groups provide the foundations for our thriving network

Spotlighting the richness of queer culture, promoting a kinder and safer working world for LGBTQIA+ folks.

Promoting understanding and exploring the different perspectives through the lens of ethnicity.

Raising awareness and advocating for the extraordinary skills and traits of veterans.

Championing equity and celebrating excellence for all people across the gender spectrum.

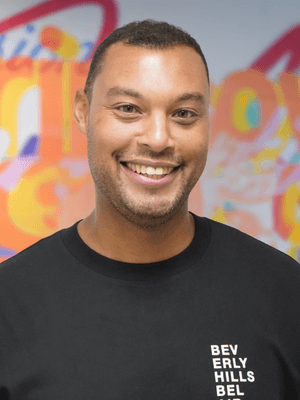

MEET GABRIELLA

Gabriella Morrey-Jones is our talent lead, recruiting for all roles in Trinnovo Group.Get in touch with Gabriella using the Work for Us form below.

MESSAGE